When it comes time to buy motorcycle insurance, you’ll likely experience a bit of sticker shock. There’s no getting around it; motorcycle insurance costs more than you’d expect for such a small vehicle. So, why is motorcycle insurance expensive?

There can be many reasons, and we’ll break them down for you. Then, we’ll show you how to save money.

Average Cost of Motorcycle Insurance by State 2023

The average motorcycle insurance cost in the US is $721 a year. However, this can vary depending on your age, coverage, and other factors. So, how much is motorcycle insurance in your state?

Here’s a breakdown:

| Rank | State | Avg. Monthly cost |

| 1 | California | $151 |

| 2 | Louisiana | $95 |

| 3 | Missouri | $85 |

| 4 | Michigan | $79 |

| 5 | Florida | $78 |

| 6 | North Carolina | $78 |

| 7 | Kentucky | $76 |

| 8 | Rhode Island | $76 |

| 9 | Tennessee | $74 |

| 10 | Massachusetts | $72 |

| 11 | Utah | $69 |

| 12 | Mississippi | $68 |

| 13 | Montana | $68 |

| 14 | Texas | $68 |

| 15 | Oregon | $67 |

| 16 | Delaware | $66 |

| 17 | Arkansas | $65 |

| 18 | Georgia | $65 |

| 19 | Arizona | $64 |

| 20 | Oklahoma | $64 |

| 21 | Illinois | $62 |

| 22 | South Carolina | $61 |

| 23 | Washington | $61 |

| 24 | Alabama | $60 |

| 25 | Nevada | $60 |

| 26 | Maryland | $59 |

| 27 | New York | $59 |

| 28 | Virginia | $57 |

| 29 | Pennsylvania | $56 |

| 30 | Connecticut | $55 |

| 31 | Idaho | $54 |

| 32 | New Jersey | $54 |

| 33 | New Mexico | $54 |

| 34 | New Hampshire | $53 |

| 35 | Colorado | $52 |

| 36 | Ohio | $52 |

| 37 | West Virginia | $49 |

| 38 | Indiana | $48 |

| 39 | Hawaii | $46 |

| 40 | Kansas | $44 |

| 41 | Minnesota | $44 |

| 42 | Maine | $41 |

| 43 | Alaska | $40 |

| 44 | Vermont | $40 |

| 45 | Wisconsin | $40 |

| 46 | Nebraska | $38 |

| 47 | South Dakota | $38 |

| 48 | Wyoming | $37 |

| 49 | Iowa | $34 |

| 50 | North Dakota | $28 |

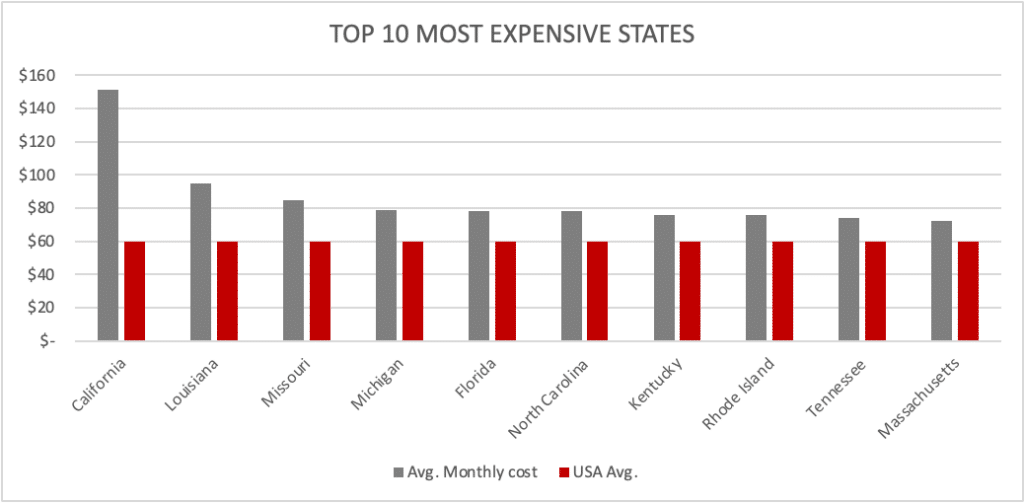

STATES WITH THE MOST EXPENSIVE MOTORCYCLE INSURANCE

Of the ten most expensive states for health insurance, seven are located in the Southern half of the country. We’ll get into the reasons for that in a minute. Here’s a quick look at the ten most expensive states:

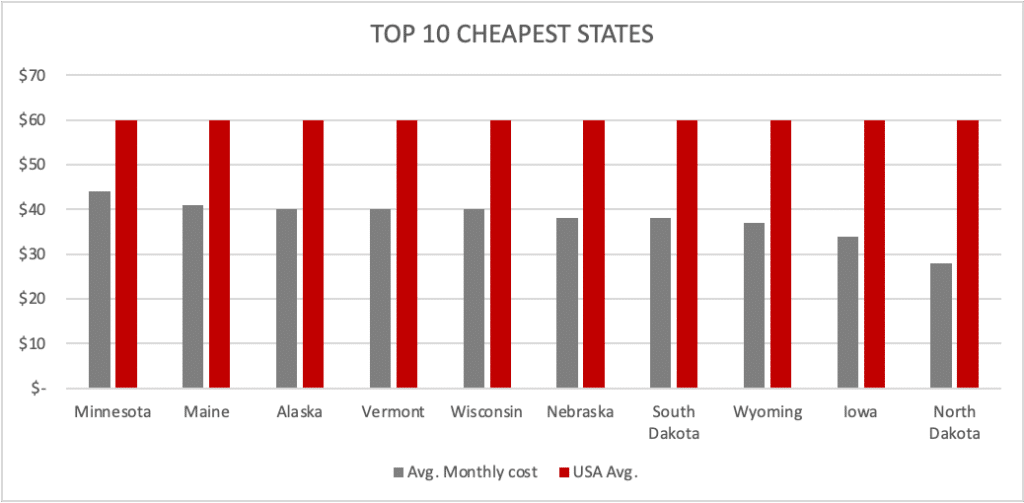

States With the Cheapest Motorcycle Insurance

Of the top 10 cheapest states for motorcycle insurance, all but one are located in the Northern half of the country. Once again, there are good financial reasons for this, which we’ll explain. Here’s a chart of the ten most affordable states for motorcycle insurance:

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

WHY IS MOTORCYCLE INSURANCE EXPENSIVE? FACTORS THAT INFLUENCE THE RATES

So, what factors can affect your motorcycle insurance costs? There are several factors. Let’s break them down.

- Location – With a few exceptions, motorcycle insurance tends to cost more in northern states. This is because the riding season in those states is shorter. In Southern California, for example, the riding season is 365 days a year. Conversely, in North Dakota, your bike will spend mos of the year in your garage, where it won’t be at risk.

- Age and riding experience – As with car insurance, younger riders will pay more for insurance. Riding experience is also a factor. So a first-time biker in their 50s will pay more than a 22-year-old with four years of experience.

- Speeding and traffic tickets – If you have traffic violations on your record, your insurance will cost more. The more violations and severe they are, the more they’ll affect your rates. That said, most violations fall off your record after three years. Follow traffic regulations, and you’ll get the best motorcycle insurance rates.

- State– With a few exceptions, motorcycle insurance tends to cost more in northern states. This is because the riding season in those states is shorter. In Southern California, for example, the riding season is basically 365 days a year. Conversely, in North Dakota, your bike will spend most of the year in your garage, where it won’t be at risk.

- Accident and claim history – Vehicle accidents will cause your insurance rates to go up. Even non-accident-related claims can drive up your rates. Accidents and claims will usually fall off your record in seven years.

- Type of bike – Your bike's type and engine size will also affect your rates. The larger the engine, the more you’ll pay for coverage. For bikes of the same displacement, sportbikes will cost more to insure than cruisers and touring bikes. In addition, more expensive bikes will also cost more to insure.

- Vehicle usage – Most insurance companies will consider how your bike is being used. If you’re a weekend rider, you can expect to pay less than someone with a commuter bike.

- Type of coverage – Your rates will be different depending on what kind of coverage you buy State minimum coverage will cost less than a comprehensive policy with high coverage. Similarly, a high deductible can save you money, although you’ll have to pay more if you actually make a claim.

- Credit – Many insurance companies, like GEICO motorcycle insurance, consider your credit rating when they give you a quote. Don’t worry about shopping around, though; an insurance quote doesn’t count as a hard check, so getting multiple quotes won’t affect your credit score

MOTORCYCLE INSURANCE Discounts

Now that we’ve talked about things that affect your rates, it’s time to look on the sunny side of things. Here are a few ways you can save money on your motorcycle insurance:

- Bundling/multiple coverages – Many insurers allow you to bundle your motorcycle insurance with your auto, boat, or other insurance policy. This can get you a significant discount.

- Safety course – Most states offer some kind of motorcycle safety course. Completing a safety course – and providing proof to your insurer – will lower your motorcycle insurance rates.

- Loyalty (coverage renewal) – Most insurance companies offer discounted rates to long-term customers. The longer you stay with the same insurer, the more you will save.

- Affiliated with organizations – Many insurance companies will offer a discount to members of certain motorcycle organizations. Organizations like the American Motorcyclist Association (AMA), charge a small membership fee. However, they provide additional benefits such as hotel discounts.

- Quote in advance – When you sign up for insurance, shop around with several companies. You might find that you get wildly different quotes. Get quotes from as many insurers as you can, and choose the one that offers you the best rates.

- Motorcycle endorsement (driver’s license) – In many states, you can ride a motorcycle with a learner’s permit, with certain restrictions. That said, you’ll get better insurance rates if you get a motorcycle endorsement on your driver’s license. Typically, this involves a written test and a road test. Check with your state’s DMV for details.

- Switching from another company – We’ve already talked about loyalty discounts. However, if you’re unhappy with your current rates, you might do better if you get quotes from other companies. Some insurers even offer discounts for customers who switch from one of their competitors.

- Paying in full – When you buy insurance, you can either pay in advance for a full year or pay monthly. Some companies even let you pay on a quarterly or bi-annual basis. Paying for the entire year in advance will get you a discount.

- Automatic bill-pay – If you’re paying by the month, some insurers offer a discount if you sign up for automated payments. Since you will pay your bill anyway, this option is a no-brainer.

For a more comprehensive overview of motorcycle insurance, visit our Motorcycle Insurance Guide for 2023

FAQ

Why is motorcycle insurance so expensive?

Due to several considerations, including the higher risk of accidents and theft compared to other vehicles, the cost of maintaining or replacing a motorcycle, and the possibility of serious injuries in the event of an accident.

What should I consider when choosing a motorcycle insurance provider?

Consider the company's financial health and stability, the degree of customer service and support, the variety of coverage options offered, the cost of premiums and deductibles, and other aspects when selecting a motorbike insurance carrier.

What factors affect the cost of motorcycle insurance?

The type of motorcycle, the size of the engine, the rider's age and driving history, the required level of coverage, the location where the motorcycle is parked or stored, and the underwriting policies of the insurance provider are just a few of the variables that can affect the price of motorcycle insurance.

What types of coverage are typically included in motorcycle insurance policies?

Liability coverage covers harm you might cause to other people and their property.

Does the type of motorcycle I ride affect my insurance premiums?

Yes. Generally, bikes with larger engines, higher top speeds, and sportier designs are more expensive to insure due to the higher risk of accidents and theft.

How can I lower my motorcycle insurance costs?

Things like taking a rider safety course, choosing a higher deductible, upholding a spotless driving record, bundling insurance policies, selecting a motorcycle with a smaller engine size, and comparing quotes from various insurance providers before making a decision.

Is motorcycle insurance more expensive than car insurance?

Due to the higher risk of accidents and injuries associated with motorcycles, motorcycle insurance is more expensive than auto insurance.

Is motorcycle insurance required in CA?

Yes, California requires motorcycle insurance. All riders must have liability insurance with a minimum level of protection of $15,000 for single-person injuries or fatalities, $30,000 for multiple-person injuries or fatalities, and $5,000 for property damage.

Is it possible to ride a motorcycle without insurance?

It is forbidden to operate a motorcycle without insurance in most states. However, it is strongly advised to obtain insurance to safeguard your finances in the event of an accident or theft, regardless of whether it is permitted in your state.