If you live in Arizona and your current motorcycle insurance policy expires on or before June 30, 2021, you may notice a sharp increase in the cost to renew it. This is because the state increased the minimum insurance coverage needed to comply with the law and avoid a fine and license suspension for a violation.

It’s always a good idea to compare insurance companies and the rates they charge for motorcycle insurance, but an increase in mandatory coverage limits makes it even more important now. Whether you prefer shopping for the best insurance company, the cheapest rates, or a combination of both, we want to make it easier for you with timely information to help you to make a smart and informed decision.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

Mandatory Motorcycle Insurance in Arizona

You must comply with state financial responsibility law to operate a motor vehicle, including a motorcycle, on public highways. Compliance requires that you show that you can pay claims made against you for bodily injuries, death, or property damage resulting from an accident that you caused.

One method of complying with the law is by having a policy of motorcycle insurance. Policies issued or renewed on or before June 30, 2020, need the following liability coverage limits:

- $15,000 to pay claims for bodily injury or death that you caused to another person through the operation of a motorcycle.

- $30,000 coverage for bodily injuries or death caused to two or more people in a single accident and subject to the limits available for one person.

- $10,000 to pay for injury caused to or destruction of property belonging to another party through the operation of a motorcycle.

The mandatory coverage limits increased for motorcycle insurance policies issued or renewed on or after July 1, 2021, as follows:

- $25,000 to pay claims for bodily injury or death that you caused to another person through the operation of a motorcycle.

- $50,000 coverage for bodily injuries or death caused to two or more people in a single accident and subject to the limits available for one person.

- $15,000 to pay for injury caused to or destruction of property belonging to another party through the operation of a motorcycle.

Mandatory Coverage Key Takeaways

- If you are at fault for an accident that results in the serious injury or death of another person, it is likely that the damages will exceed your insurance coverage.

- Liability insurance does not pay for damage to property, or for your medical bills if you suffer an injury in an accident.

- Unless you purchase additional coverage above the mandatory minimum, you may be left without compensation if the party at fault does not have insurance coverage.

Penalties for Riding A Motorcycle Without Insurance

Driving a motorcycle without carrying at least the minimum liability insurance required by state law subjects you to a two-stage process that suspends or restricts your driving privileges and imposes hefty civil penalties as follows:

- First violation: After a court imposes a civil penalty of at least $500 for a first violation of the law, the state has the right to suspend or restrict your driving privileges for as long as three months. The restrictions include limiting you to only driving at certain times of the day or for specific purposes, such as going to and from school or work.

- Second violation: The civil penalty increases to $750, and the state suspension of driving privileges for six months includes suspension of the registration and license plates of your motorcycle for six months.

- Third and subsequent violation: Three or more violations within 36 months subject you to a $1,000 civil penalty and suspension of driving privileges, registration, and plates for one year.

You may be able to avoid or reduce the civil penalties for a violation of the insurance law by bringing to court a copy of your driving record showing that you have not committed a similar violation within the past 24 months or have not had more than one violation in the past 36 months. You also must bring to the court proof of purchase of a six-month insurance policy that satisfies the minimum insurance requirements.

Cost of Motorcycle Insurance in Arizona

Reporting on the average cost of insuring a car or motorcycle presents a challenge because of the different coverage options that can be added or omitted from a policy to affect its cost. Other factors that influence the price of insuring a vehicle include:

- Accidents and traffic offenses increase the cost of insurance.

- Where you live may increase what you pay for insurance based on theft and accident statistics.

- Young drivers or ones who are newly licensed generally pay more for insurance.

- More miles driven increases the likelihood of an accident and raises insurance costs.

- Insurance companies generally charge more to insure male than female drivers based on accident statistics.

- Some types of motorcycles may have a higher incidence of accidents than others.

- A low credit score may result in a person paying more for insurance.

The overall claims paid by an insurance company affect the insurance rates it charges. You may have a clean driving record, but claims paid because of accidents and claims by other policyholders affect what companies charge for the policies they write.

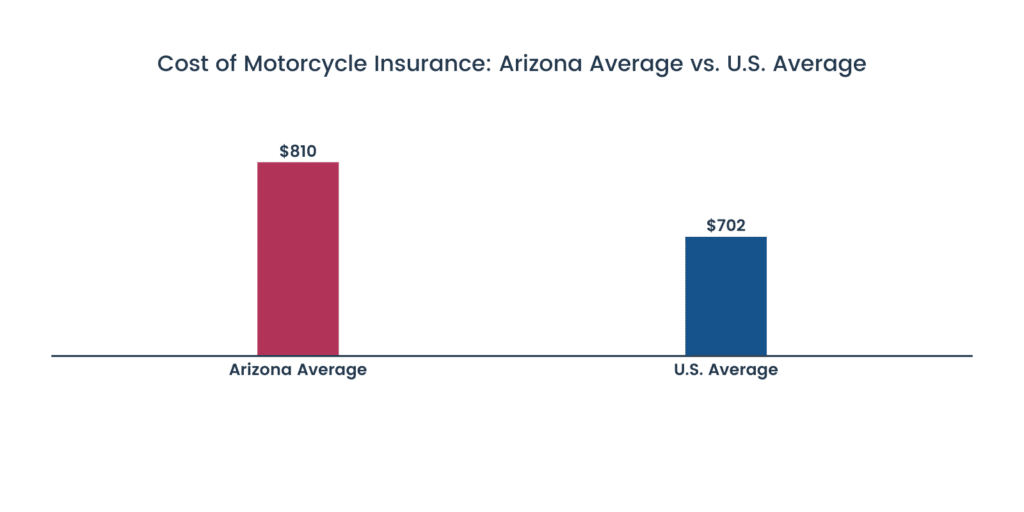

Motorcycle Insurance average cost in Arizona

Information gathered from available sources shows the average cost to insure a motorcycle in Arizona to be $810. The average cost in the state is more than the national average of $702. The averages are for policies containing more than the minimum bodily injury and property damage coverages required by state law.

Average Motorcycle Insurance Cost By Age

All other driver variables being equal, your age plays a part in determining how much you pay for motorcycle insurance. A 25-year-old insuring a motorcycle can expect to pay about $100 more for the same coverage as a 55-year-old insuring the same type of motorcycle according to one source.

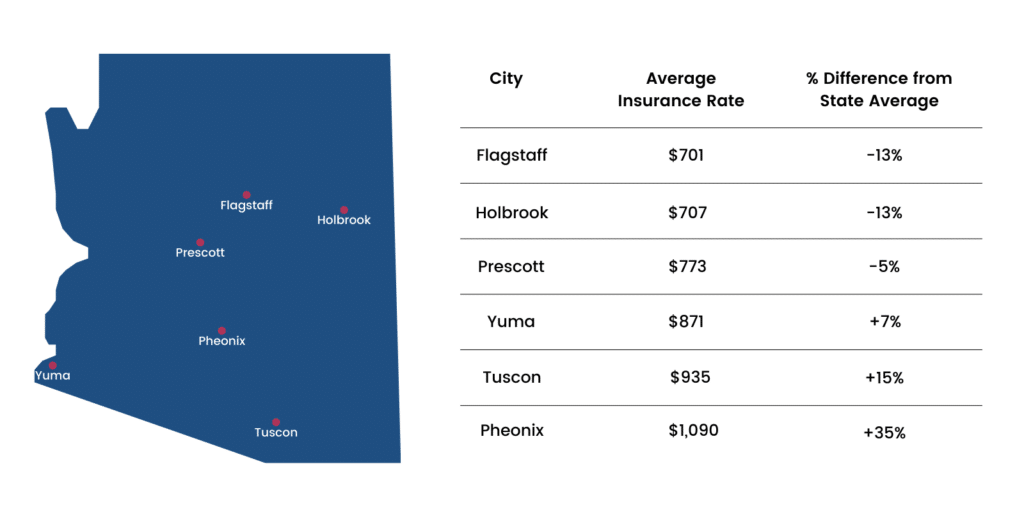

Motorcycle Insurance Average by Region

Age is not the only variable affecting the cost of motorcycle insurance. A look at rates throughout Arizona shows a significant difference in the average cost of insuring a motorcycle depending upon where you live. For example, if you live in Flagstaff, the average rate charged for insurance is $701, which is 13% below the statewide average. Moving to Mesa could substantially increase how much it costs to buy insurance for your motorcycle because the average rate is $1,110, which tops the statewide average by 27%.

The Cheapest Motorcycle Insurance in Arizona

Everyone has their own reason for choosing a particular insurance company when they need motorcycle insurance. For some, it may be outstanding customer service while others may want collision and comprehensive coverage that pays for original equipment manufacturer or OEM parts. Price seems to be one thing they all seem to agree on even if it is not the primary reason for choosing a particular company. It seems as though no one wants to pay more than they need to for motorcycle insurance.

Two companies insuring motorcycles in Arizona stand out for their appeal to the shoppers looking for the cheapest motorcycle insurance quote: Nationwide and Progressive. Nationwide had an average cost for a policy of $653 that beat the statewide average by an impressive 19%. Right behind it was Progressive that beat the statewide average by 15% with an average policy cost of $686. If you are looking for the cheapest motorcycle insurance Arizona has to offer, either of these companies deserves a look.

The Best Motorcycle Insurance in Arizona

All insurance companies invest a sizable sum of money into marketing to make themselves stand out from the pack. To choose our picks for the best motorcycle insurance in Arizona, we decided to ignore the advertising and, instead, focus on price or affordability, the coverage options offered, and how they stack up against the competition in providing consistently outstanding service to their customers.

The Best-rated Motorcycle Insurers in Arizona

We relied on three highly respected organizations, J.D. Power, National Association of Insurance Commissioners, and A.M. Best, to provide the information to compare motorcycle insurance companies in terms of customer service. The scores developed by the J.D. Power study of insurance companies offering policies in Arizona, the complaint index compiled by NAIC, and the financial strength rating from A.M. Best provided the following results:

| Compay | NAIC | J.D. Power | A.M. Best |

|---|---|---|---|

| Geico | 1.20 | 8/13 | A++ |

| State Farm | 0.57 | 3/13 | A++ |

| Progressive | 0.42 | 11/13 | A+ |

| USAA | 1.14 | 2/13 | A++ |

| Farmers | 0.30 | 10/13 | A |

| Allstate | 0.69 | 4/13 | A+ |

| American Family | 0.69 | 5/13 | A |

| Liberty Mutual | 1.18 | 9/13 | A |

| CSAA | 1.36 | 7/13 | A |

| Nationwide | 0.43 | 13/13 | A+ |

| Dairyland | 2.12 | — | A+ |

The rating by NAIC reflects complaints made relative to a company’s share of the market. A 1.0 indicates that complaints were consistent with the market share. The J.D. Power rank indicates where a company ranked in a survey of customer opinion of 13 companies. The rating from A.M. Best is an indicator of a company’s ability to meet its financial commitments to its insureds.

Our Choices For The Best Motorcycle Insurance Companies in Arizona

You have many options from which to choose when the time comes to purchase motorcycle insurance. To help with your decision, we provided a great deal of information for you to take into consideration, and now consolidate it into our picks for the best motorcycle insurance in three separate categories:

- Progressive — Best insurance company for most people: Winning top honors as the overall best motorcycle insurance in Arizona for most owners and riders is Progressive. It offers a number of popular coverage options, including payment for OEM parts and endorsements providing coverage for the customization that motorcycle owners like to add. Its policies are priced below the state average, and the company offers programs that may allow policyholders to receive rate discounts.

- Nationwide – The best insurance company for affordability: If you want the cheapest motorcycle insurance in Arizona, Nationwide has it with average costs that are 19% below the average for the state. The good news is that Nationwide offers much more than just inexpensive insurance rates. It ranks right up there with Progressive as being one of the best motorcycle insurance companies offering policies in Arizona with a wide selection of coverage options.

- State Farm – The best insurance company for customer service: If customer service is important to you when deciding on a company for motorcycle insurance, State Farm with the third spot out of 13 in the J.D. Power survey of customer satisfaction may be the company for you.

Before choosing a company to insure a motorcycle, take a few minutes to list the coverage you want and review your budget to determine what you can afford to spend. That information, along with everything you learned about Arizona motorcycle insurance from what we offered, makes you a smart and informed shopper.

Tips to Choose the Best Motorcycle Insurance in Arizona

Value Penguin evaluated over 250 offers in three categories to determine the best car insurance company in Arizona. The best motorcycle insurance companies share three characteristics:

- Affordable: The price you can expect to pay for a typical Arizona motorcycle insurance buyer.

- Coverage option: How to compare coverage provided by one company with another.

- Customer Service: Does the insurance company consistently meet the needs of policyholders?

Your motorcycle insurance should be affordable enough that you can consider purchasing additional compensation if you choose so. But even without supplements, the policy must provide adequate coverage without purchasing add-ons. Your motorcycle insurance should also be able to meet the needs of its policyholders and respond fairly to claims.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.