From small towns and rugged landscapes reminiscent of the old west to coastal regions, and modern metropolitan areas, Texas has a great deal to offer the motorcycle enthusiast looking for places to explore. Even if your riding is limited to commuting to and from work with an occasional weekend getaway, Texas has a lot to offer.

Whether you are new to motorcycles or have years of riding experience, staying safe should be your top priority every time you start the engine. A motorcycle license, insurance coverage, and, depending on your age and completion of a motorcycle training course, wearing a helmet ensure compliance with Texas motorcycle laws.

Motorcycle Insurance Requirements in Texas

You need to show proof of insurance coverage to register a motorcycle or obtain a license to operate a motorcycle in Texas. Unlike other states that require multiple coverages that include payments toward personal injuries or property damage incurred by the insured in an accident, Texas only requires liability insurance coverage.

Liability insurance pays any claims made by drivers and occupants of other vehicles, pedestrians, and anyone else who is injured or whose property is damaged as a result of your negligent or careless operation of a motorcycle.

Your insurance company handles the claim on your behalf and pays for the services of an attorney to defend you in any lawsuit filed by a party seeking to recover damages against you.

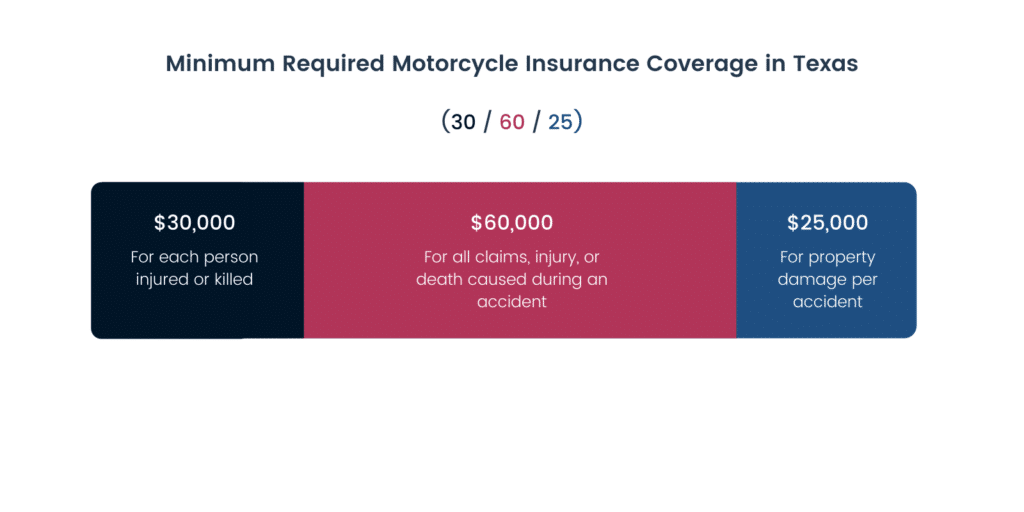

Minimum Motorcycle Liability Insurance In Texas

Operators of motorcycles, mopeds, and motor-driven cycles used on public roadways in Texas must have the following minimum liability insurance coverage to comply with state law:

- $30,000 for causing injuries or death to one person.

- $60,000 for all claims for injury or death caused in an accident.

- $25,000 for property damage.

The basic coverage requirements for motorcycles also apply to cars. You may see or hear it referred to as 30/60/25 coverage. Dirt bikes, all-terrain vehicles, and minibikes may not be used on public roads, so the basic insurance requirements do not apply to them.

Penalties For Not Having Minimum Liability Insurance

The state takes a hard line against people caught riding in violation of the motorcycle insurance requirements Texas imposes. For example, the conviction of a first offense may result in fines ranging from $175 to $350. It only gets worse if you get caught again.

If you have a prior conviction for riding a motorcycle without insurance, subsequent convictions may bring fines ranging from $350 to $1,000. As an additional penalty for repeat offenders, the state has the authority to suspend your license and registration for up to two years unless you obtain and submit proof of insurance.

As previously mentioned, Texas is tough on people who ride motorcycles or other vehicles without having the required insurance coverage. It proves this by authorizing judges to order the county sheriff to impound the motorcycle or other vehicle of anyone convicted of a second or subsequent charge of operating without insurance.

An impounded vehicle must be held for 180 days, and the sheriff cannot release it sooner without a court order obtained by its owner. The court will not release an impounded motorcycle unless the owner presents proof of insurance coverage effective for two years from starting from the date of the request for the vehicle’s release.

What Does Motorcycle Insurance Cost in Texas?

Motorcycles must comply with the same minimum insurance laws as cars in Texas, so we looked at car insurance data available from different sources to learn the average cost to insure a car in Texas. At the minimum coverages, the cost would average $524 a year.

If you add additional coverage, such as uninsured and underinsured motorist, comprehensive, and collision, your average cost could shoot up to $1,823 annually.

Insurance companies set premiums based on what they perceive to be their risk of having to pay a claim under the policy. Characteristics that may influence what you pay for insurance include the following:

- Your age and experience: A young, newly licensed rider will probably be viewed as a greater risk of causing an accident than a more mature rider who has been licensed for a number of years. Of course, there are exceptions, but crash data points to a higher accident rate for young motorists.

- Gender: Statistically, male drivers have more accidents than females.

- Frequency of use: The more miles you travel in a car or on a motorcycle, the more likely you are to be involved in an accident. Remember, accidents mean claims, and insurance companies do not want to pay claims. The more miles you ride over the course of a year may increase the cost of purchasing insurance coverage.

- Your driving record: Moving violations, including speeding, failure to signal, and stop sign or red-light violations equate to unsafe driving according to insurance companies. The same holds true for accidents. If you want to keep your insurance costs low, avoid accidents, and obey the traffic laws.

Where you live may influence how much you pay for motorcycle insurance. A motorcycle used and parked on the streets of Dallas or any of the other large cities in the state may cost more to insure than if you live in a rural or suburban area. The reason is that an insurance company may consider congested urban areas as having a higher risk of vandalism, theft, and accidents.

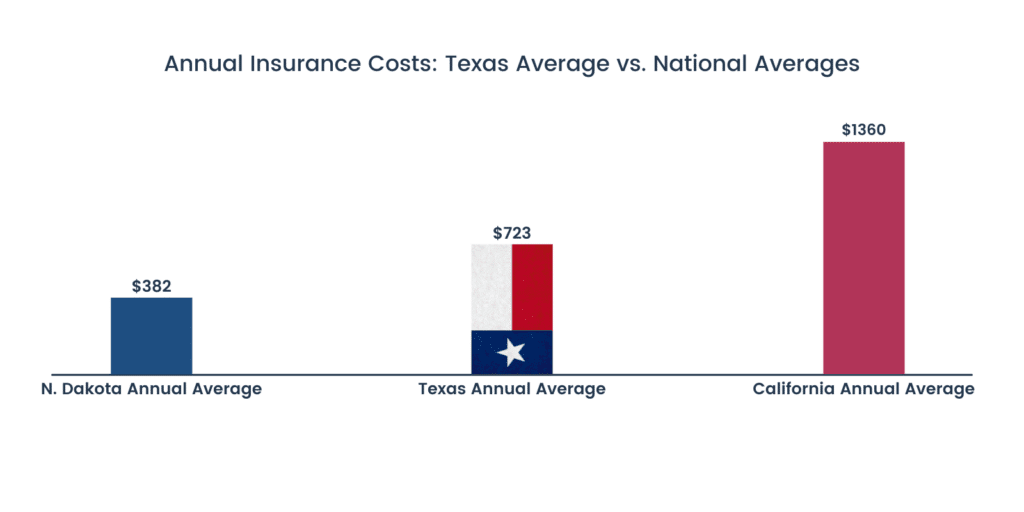

Average Cost of Motorcycle Insurance in Texas

Various sources reveal the average cost of motorcycle insurance in the United States to range from a low of $1382 in some states to a high of $1,360 annually. The average in Texas is $723, but keep in mind that averages can be deceiving because how you ride, where you live and other variables, including your age and driving record, will influence the rate you pay for insurance.

Motorcycle Insurance Averages by Age

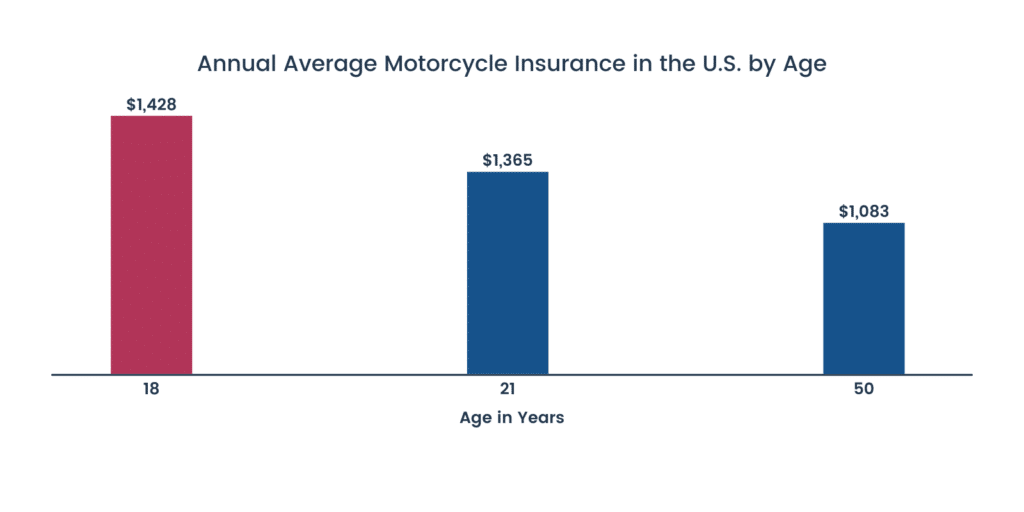

If you recall, we mentioned that someone with a higher potential for a claim against a policy will pay more than another rider seen by an insurance company as having a lower risk, so it should come as no surprise that younger riders pay more for motorcycle insurance on average.

According to available sources reporting on the topic of age and how it affects motorcycle insurance costs, An 18-year-old motorcyclist pays an average of $519 for insurance in the U.S with fluctuations of as much as $400 to $500 depending on the state in which the rider lives, driving record, type of motorcycle and other factors.

An analysis of insurance costs for riders living in one state with all variables being equal except for age reveals that an 18-year-old rider pays an average of $1,428 a year for motorcycle insurance. The same coverage for a 21-year-old would average $1,365 while the average annual cost for a 50-year-old would be $1,083.

Motorcycle Insurance Averages by Region

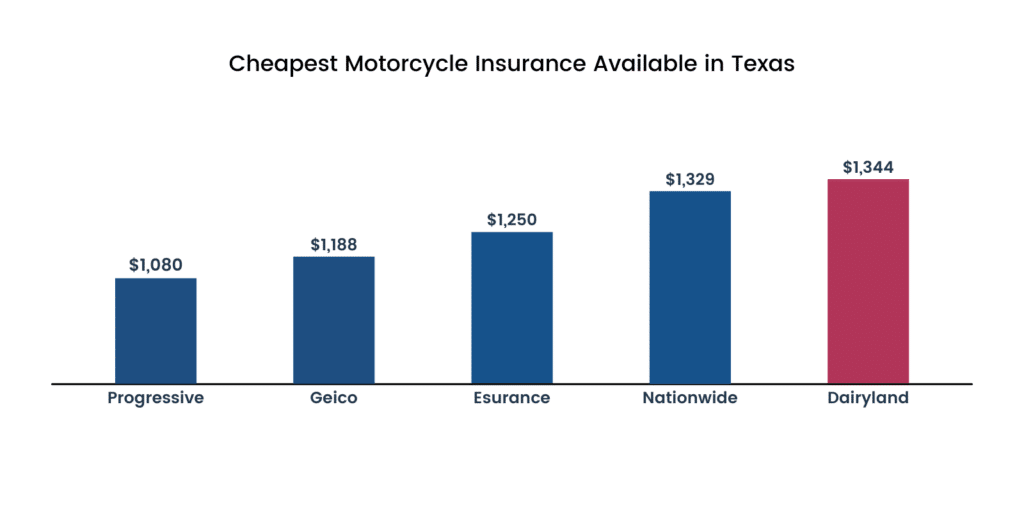

A review of available sources shows that Progressive, with an average rate of $1,080 for a policy that included collision and comprehensive coverages, offers the cheapest motorcycle insurance in Texas. For comparison, here are the average prices of the other five companies offering the cheapest rates in the state for the same coverage:

When comparing one company against another for the cheapest motorcycle insurance quote, accuracy dictates that you first determine what you will be comparing.

Except for the minimum liability coverage that you must have to be in compliance with the law, shopping for motorcycle insurance can best be described as an ala carte menu at a restaurant offering a variety of choices. Some of the coverage options you may wish to consider for your motorcycle insurance policy include:

- Collision coverage: Regardless of who may be at fault in causing an accident, collision coverage gives you the option of having your insurance company pay for repairing the damage done to your motorcycle excluding your deductible, which you must pay out of pocket towards repairs.

- Comprehensive coverage: When your motorcycle is lost or damaged through events unrelated to a collision, your insurance company will pay to repair or replace it under the comprehensive coverage of your motorcycle insurance policy. Damage caused by hail, fire, flood, or vandalism would be repaired under comprehensive coverage. It also pays to replace a motorcycle or any of its equipment that is stolen. As with collision coverage, having a deductible reduces your cost for the coverage.

- Uninsured and underinsured coverage: If you suffer injuries in an accident caused by a motorist who does not have liability insurance or who does not have enough insurance to pay the medical expenses and other damages you incurred, uninsured and underinsured coverages allow you to file a claim against your insurance company.

Other than the minimum liability insurance that you must carry in order to lawfully ride on public roads in Texas, it is up to you to decide whether having the protection other coverages offer is worth the added expense.

Best Motorcycle Insurance in Texas

Cost is an important consideration when buying motorcycle insurance, but other factors may enter into the decision about which company you choose. Ease of reporting a claim, responsive customer service, and other attributes can make one insurance company stand out from the rest.

To make shopping easier for you, we looked at each of the companies offering motorcycle insurance in an effort to find the best ones. What follows is the best motorcycle insurance Texas has to offer based on what other organizations have to say about them, followed by our picks of the best ones in different categories.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

Best-Rated Motorcycle Insurance Companies in Texas

One of the criteria we used in making our selections for best companies for motorcycle insurance in Texas was the ratings they received from three nationally known and respected organizations: The National Association of Insurance Commissioners or NAIC, J.D. Power, and A.M. Best.

The NAIC complaint index rates insurance companies on the number of consumer complaints compared to the company’s market share. A company with a perfect score would have 1,000 points.

J.D. Power conducts customer surveys and uses the feedback they receive on billing, claims, and agents to assign a score to a company, up to a maximum of five.

The financial strength rating from A.M. Best offers a different perspective by focusing on the ability of an insurance company to withstand economic downturns or a sudden increase in claims. Companies receive a letter grade with A++ being the highest grade given and reflecting a company exhibiting superior financial strength.

Following are the ratings given by the three organizations to insurance companies issuing policies in Texas for motorcycles:

| Company | J.D. Power | NAIC | A.M. Best |

|---|---|---|---|

| Dairyland | — | 0.20 | A+ |

| Esurance | 3 | 1.30 | A+ |

| Geico | 3 | 0.68 | A++ |

| Markel | — | 0.00 | A |

| Progressive | 2 | 0.69 | A+ |

An NAIC rating of 0.00 indicates that the company received no complaints in this state.

Our Picks For The Best Motorcycle Insurance Companies in Texas

Instead of coming up with the overall best motorcycle insurance company in Texas, we decided to go with four. We recognized that getting the cheapest price may be important for some people while others may value customer service over price, so we came up with the best company in each of three categories:

- Best company for most people: Geico offers affordable pricing, popular coverage options, and exceptional customer service and claims handling to be our pick as the best motorcycle insurance company for most people. Its average cost for a policy in Texas that includes more than only liability coverage is $651.

- Best company offering the lowest average rates: Progressive features the lowest average cost in Texas at $645 for insurance on a motorcycle. It may not match Geico in customer satisfaction rating, but it comes in as the cheapest option for anyone putting a premium on price when shopping for insurance.

- Best company for owners of multiple motorcycles: For folks with multiple motorcycles parked in their garage or on the driveway, Dairyland ranks tops with multivehicle discounts, OEM parts, and full-replacement coverages that may offset its higher average cost of $704 for motorcycle collectors in Texas.

The company and coverage you end up selecting for your motorcycle have to meet your needs and fit within your budget. Hopefully, the information we provided proves helpful in getting you the best motorcycle insurance Texas has available and at the lowest price.

What To Do If You Get Pulled Over Without Insurance

If you are pulled over and arrested for the first time without proof of car insurance, you will be subject to a subpoena and a $ 175- $ 350 fine.

In addition, you will have to pay an additional $ 250 each time you renew your license over the next three years. If you do not have car insurance on your second stop, you will be subject to another subpoena and a $ 350- $ 1,000 fine. Again, registration for the next three years will result in a $ 250 annual fine.

You can also revoke your driver’s license if you are considered a habitual offender of uninsured driving. If you’re worried about the cost of motorcycle insurance, be aware that there are ways to reduce your insurance premiums in Texas. In the long run, it’s always cheaper to choose insurance than to assume that you don’t need it.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.