Of the more than 8.5 million motorcycles registered in the United States, the 645,012 registered in Florida makes it the second most popular state for motorcycle ownership. Laws pertaining to motorcycle insurance in Florida also make the Sunshine State stand out from most other states because it does not impose the same insurance requirements on motorcycles as it does on other types of motor vehicles.

Motorcycle Insurance Requirements Florida

Most states require proof of insurance coverage in order to register a motor vehicle, but Florida law differs in a couple of ways. First, it does not, as a general rule, require bodily injury liability coverage to pay claims filed against you by drivers or passengers injured in accidents that you cause.

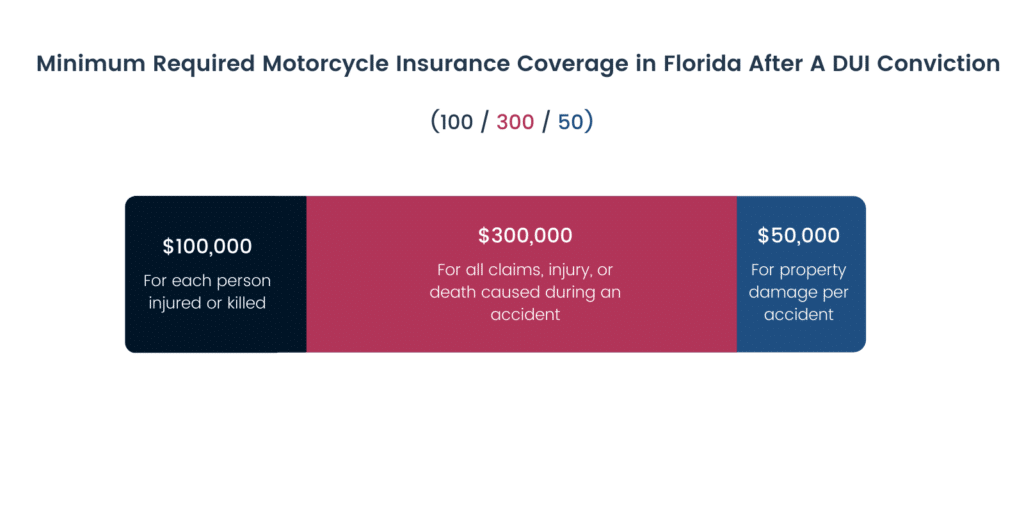

The exception to the general rule in Florida about not needing bodily injury liability insurance to register a vehicle applies to someone convicted of driving while under the influence. To register a vehicle after a conviction for DUI, you must have an insurance policy with the following minimum coverage:

- $100,000 bodily injury liability for injury or death to one person per accident.

- $300,000 bodily injury liability for injury or death to two or more people per accident.

- $50,000 property damage coverage.

The second thing that makes Florida stand out from most states is the fact that it is a no-fault state. Instead of having to file a lawsuit against the party at fault in causing an accident in order to recover damages, including medical expenses and lost earnings, drivers and passengers file a claim against the insurance company insuring the vehicle in which they were riding.

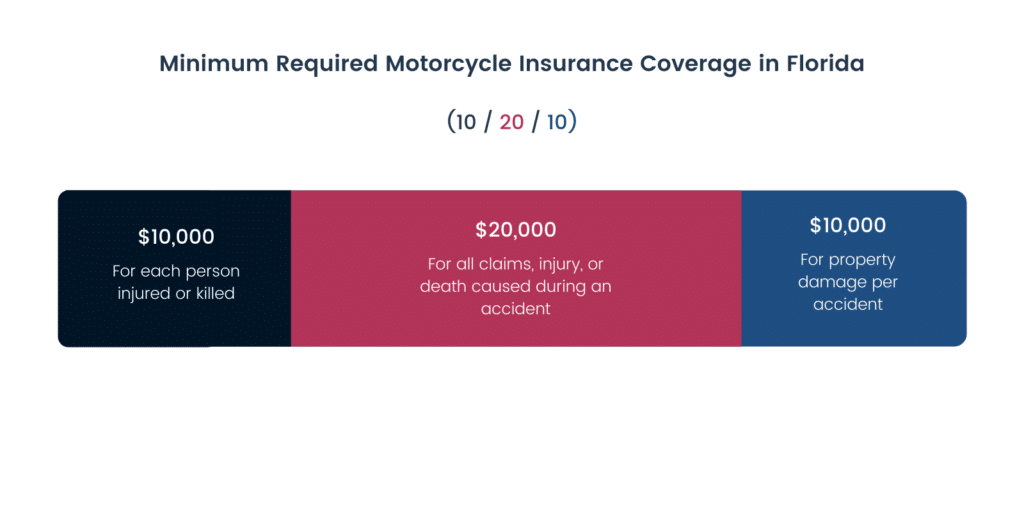

To register a vehicle in Florida, you must show proof of an insurance policy with at least $10,000 in personal injury protection, which is also referred to as PIP coverage, and $10,000 in property damage liability coverage. The PIP coverage on your vehicle pays medical bills and lost earnings for you and any passengers in your vehicle without the need to sue or fault. The property damage liability coverage pays for damages you cause to the property of another party, such as driving into a fence or another vehicle.

The insurance requirements that drivers of other motor vehicles must meet in Florida do not apply to motorcycles. The no-fault laws that cover a bicycle rider or a pedestrian in Florida also do not apply to motorcycle drivers and their passengers.

Motorcycle Insurance Coverage Minimums

Unlike other states, Florida does not require the same mandatory insurance to register a motorcycle as you need to register other types of motor vehicles. However, motorcycle riders who do not wear a helmet must carry at least $10,000 in health insurance coverage to pay their medical bills when injured in an accident. If you elect to obtain a policy of motorcycle insurance, you may satisfy the medical benefits requirement by including PIP coverage as part of the policy.

Florida no-fault laws, which ensure that medical bills of a driver and passengers are paid through the insurance on their own vehicle, do not require proof of fault. A claim is made and paid regardless of who was responsible for causing the collision. The purpose of no-fault laws is to reduce personal injury lawsuits by allowing people to collect the costs of medical treatment and lost earnings from their own insurance companies.

No-fault laws in Florida specifically exclude motorcycle riders. The result is that an injured motorcycle operator or passenger must sue another party whose fault caused an accident in order to recover damages, including reimbursement for medical bills and lost earnings.

Penalties for Not Having the Required Minimum Coverage

Although insurance is not mandatory in the state, as the owner or operator of a motorcycle in Florida, having a policy that includes liability coverage to protect you against claims for property damage and bodily injuries that you cause reduces the financial risks in the event of a crash. Adding PIP coverage to the policy provides peace of mind knowing you have a readily available source for payment of medical bills and earnings lost as a result of a crash.

Another reason to ignore the lack of motorcycle insurance requirements Florida has in place and get an insurance policy has to do with the state’s financial responsibility law. The law makes the owner and operator of a motor vehicle, including a motorcycle, financially responsible for injuries to a person or damage to property resulting from an accident they caused.

An insurance policy puts you in compliance with Florida financial responsibility requirements as long as it includes the following minimum coverages:

The Cost of Motorcycle Insurance in Florida

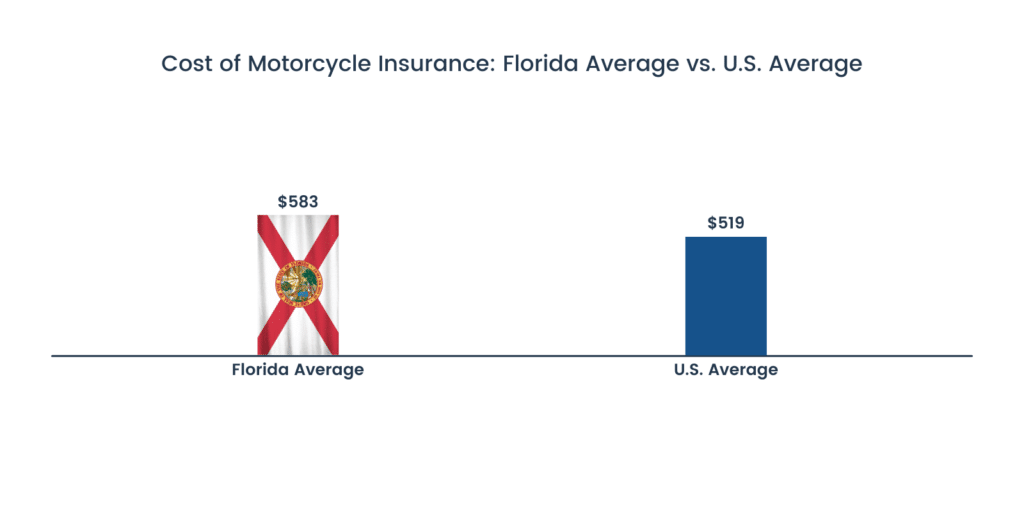

The average annual cost to insure a motorcycle in the United States is $519 according to the NADA Guide published by J.D. Power. Average costs can, when it comes to motorcycle insurance, be misleading. Several variables affect the cost that a particular person may be quoted by an insurance company for a motorcycle insurance policy, including:

- Age: Young drivers generally pay more for motorcycle insurance than do older drivers with similar driving records simply because insurance companies look at accident statistics and see that young drivers have more accidents.

- Gender: Again, based on data collected about accidents, female drivers tend to have better driving records than do their male counterparts.

- Location: Where you live affects how much you pay for motorcycle insurance, so someone living in states, such as New York or California, where the cost of living is high, may pay more than someone in Iowa or North Dakota. According to J.D. Power, what you pay in Florida to insure a motorcycle could be almost $500 less than someone might pay for the same coverage in California.

- Use: The occasional rider who does not put many miles on a motorcycle over the course of a year generally pays less for insurance coverage than someone who is a daily rider.

- Value: If you opt for collision coverage, which pays for damage to your motorcycle regardless of who was at fault in causing a crash, a newer, higher-valued motorcycle costs more to insure than an older motorcycle with a lower value.

- Driving record: If you have a clean driving record with no accidents or traffic violations, an insurance company sees you as less of a risk to insure than an operator with a history of accidents or traffic tickets.

These are only some of the variables that insurance companies take into consideration when setting rates for motorcycle insurance.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

Motorcycle Insurance Average in Florida

According to the information we’ve gathered, we found the average annual cost of motorcycle insurance in Florida to be $583, but don’t forget what we cautioned about averages when it comes to motorcycle insurance. Your age, driving record, and the other variables that insurance companies use to decide the rate charged for a policy affect your final cost.

Another factor to be taken into consideration when looking at rates is coverage. A bare-bones policy with only the basic bodily injury and property damage liability coverages along with PIP will cost less than a policy that includes the following optional coverages:

- Collision: Pays for damage to your motorcycle in an accident regardless of who was at fault in causing it.

- Comprehensive: It pays for repairs to your motorcycle for non-collision events, such as floods, hail, or vandalism. It also covers you against loss caused by theft.

- Uninsured motorist: Pays for damages you incur in a collision caused by another motorist when the other vehicle does not have liability insurance coverage.

- Underinsured: Pays you for injuries suffered in an accident caused by another motorist whose liability insurance coverage is insufficient to pay the damages you incurred.

Before shopping for insurance, you need to decide on the types of coverage and amounts you want in order to be able to compare quotes from different companies to get the most favorable rate.

Motorcycle Insurance Averages by Age Bracket

As a general rule, younger riders pay more for motorcycle insurance than older riders assuming that coverages, driving records, and other variables insurance companies use to set their rates are the same. One source that we looked at compared quotes from the same insurance company with all factors other than age being identical and found that a 25-year-old motorcycle operator would pay almost $100 more than someone who was 55 years of age.

Motorcycle Insurance Averages by Region

The average cost of motorcycle insurance in Florida varies depending upon where you live in the state. For example, a rider living in Port St. Lucie will find the average annual cost of a policy to be $454. The average cost for the same policy increases to $1,353 by moving south along the coast to Miami.

Who Has The Cheapest Motorcycle Insurance in Florida?

If you want the cheapest motorcycle insurance, Florida makes it possible by only getting the minimum coverage needed to satisfy the financial responsibility requirements. The problem with that method of keeping costs low is that the coverage amounts are woefully inadequate to protect you against financial ruin when sued by someone injured in an accident that you caused.

Instead, we looked at rates from several companies for policies with coverage limits higher than the legally required minimums. What we discovered was that the cheapest motorcycle insurance quotes throughout the state came from Esurance with an average annual cost of $584. The next cheapest motorcycle insurance quote came from Geico at $613.

As a reminder, avoid the temptation to ride while shopping for the cheapest motorcycle insurance. Even though you do not need to show proof of insurance coverage to register a motorcycle, riding without it violates Florida financial responsibility law.

The Best Motorcycle Insurance in Florida

An insurance company may win you over with the cheapest price for motorcycle insurance, but other factors, such as customer service and financial strength, may outweigh pricing and influence your decision. The sections that follow offer a look at the top-rated companies along with our selections for the best companies providing the best motorcycle insurance Florida has to offer.

The Best-Rated Florida Motorcycle Insurance Companies

J.D. Power consumer satisfaction surveys, A.M. Best financial strength ratings, and the complaint indexes compiled by the National Association of Insurance Commissioners have taken the guesswork out of choosing the best-rated companies. The following are the top-rated insurance companies doing business in Florida and their ratings from the three organizations:

| Provider | J.D. Power | NAIC | A.M. Best |

|---|---|---|---|

| Dairyland | — | 2.12 | A+ |

| Esurance | 3/5 | 1.30 | A+ |

| Geico | 3.5 | 0.92 | A++ |

| Markel | — | 0.00 | A |

| Progressive | 2/5 | 0.69 | A+ |

J.D. Power surveys represent customer experiences with each company. A company’s NAIC index represents the number of complaints in comparison to the insurer’s market share. A company’s financial stability, which represents its financial strength and ability to pay claims and meet its commitments to policyholders.

The Best Motorcycle Insurance Companies in Florida

We decided to give you three categories of best motorcycle insurance companies in Florida. We factored in the cost of a policy, customer service, and flexible coverage options to come up with the following selections:

- Best for most riders – Progressive: If you are looking for a mix of affordable rates and flexible options when it comes to available coverages, then Progressive may be the company for you. It offers full-replacement-cost coverage and original equipment parts coverage that is popular with many owners of motorcycles.

- Best for cheapest coverage – Esurance: You may be able to find lower rates from smaller companies, but Esurance low rates along with an impressive assortment of coverage options and rate discounts.

- Best specialty insurance – Markel: A comprehensive array of coverages designed specifically for motorcycle enthusiasts, including coverage for trailers and mechanical breakdowns, from a company that specializes in motorcycle insurance.

Finding the best motorcycle insurance Florida offers starts by deciding on the coverage options you want and using it to solicit quotes from different companies. Use the information we’ve provided to compare the companies and select one that meets your needs while staying within your budget.