You’re planning a two-week road trip on a motorcycle that a friend had in storage and let you borrow. Most states require motorcycle insurance coverage, but you don’t want to pay for a six- or 12-month policy. Here is when temporary motorcycle insurance may offer a better alternative.

Temporary motorcycle insurance is a policy for less than the standard coverage time. It’s the perfect option when you only need insurance for days, weeks, or months.

This article explores the situations that arise when temporary motorcycle insurance may come in handy and also looks at the types of policies insurance companies offer. Along the way, you’ll learn how to get temporary insurance and tips to help you save money when choosing a policy.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

What is temporary motorcycle insurance?

Consider purchasing temporary motorcycle insurance when needing insurance for under six months. Let’s face it; motorcycle insurance is expensive in part because accident statistics prove that motorcycles are more likely to be in a crash than other types of vehicles, so why pay for insurance when your bike is off the road? Instead of a standard insurance policy, look at short-term motorcycle insurance.

Riding without insurance is illegal in most states, and it can be a huge financial mistake when you’re involved in an accident. The liability and property damage coverages of a standard motorcycle insurance policy pay claims made by accident victims for collisions you caused, and they also pay for the defense lawyer to handle any lawsuit the victims file against you.

You can add coverage to a motorcycle insurance policy to pay your medical bills in case of a crash and to cover the cost of damage to your bike. A motorcycle accident could result in financial ruin if you don’t have insurance, but you can have insurance coverage without paying for a 12- or six-month policy.

If you’re borrowing a friend’s motorcycle for two weeks to take on vacation, get a short-term motorcycle insurance policy with coverage for only two weeks. When the vacation ends and you return the motorcycle to your friend, the policy and premiums also end. You get peace of mind knowing that you comply with the law and have financial protection while enjoying the fun of traveling on a motorcycle.

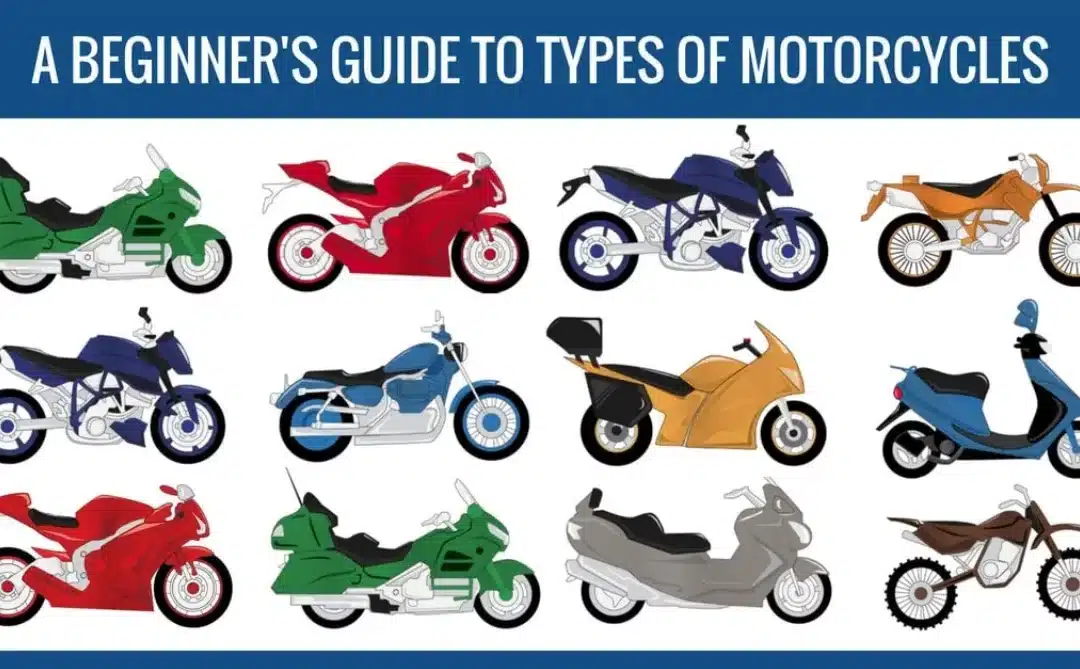

Types of temporary motorcycle insurance

The different types make matching a policy to your specific need easy. Some types of short-term motorcycle insurance is currently available include:

- Storage Insurance: If you put your motorcycle in storage for a portion of the year, you don’t need liability and property damage coverage in case you cause an accident. You want a policy that covers you in case your motorcycle is stolen or damaged while in storage. A storage insurance policy offers what you need without the added expense of unnecessary coverage.

- Seasonal insurance: Some motorcycle owners ride only during part of the year. Seasonal motorcycle insurance policies let you get the insurance you need to ride during the months you want without paying for months when your motorcycle remains idle.

- Daily insurance for motorcycles: Whether you borrow a motorcycle from a friend to take on vacation or rent one for the day, you still need insurance. A daily policy lets you pay only for the time you need to cover claims and damages in case of an accident. Rental agencies usually offer insurance as part of the rental agreement, but call the agency in advance to find out the cost. You may discover that daily insurance is your best way to get cheap motorbike insurance for only a few days.

- Monthly insurance: If you only need insurance for a short time, a monthly policy may be a good option. Whether you need to use your motorcycle to commute to work while your car is in the shop or want to take a motorcycle road trip, a monthly policy may work out better than buying long-term insurance for motorbikes.

When you shop for insurance prices, temporary motorcycle insurance may be better than long-term policies.

Who needs short-term motorcycle insurance?

For many, short-term motorcycle insurance offers a better alternative than standard, longer-term policies. People who should consider temporary insurance for motorbikes include:

- College students returning home during breaks: A motorcycle may remain in the garage for most of the school year until a student needs it to get around when home during winter, spring, and summer breaks. Temporary motorcycle insurance offers a cost-effective way for students to use their motorcycles when home without paying for a policy while away.

- Test rides: A test ride is an essential part of the shopping process when you’re in the market to buy a motorcycle. The best way to know that you have insurance coverage in case something happens during the test ride is to obtain a short-term motorcycle insurance policy in advance. It’s the only way to know for sure that you are protected in the event of an accident.

- Renting a motorcycle: Before committing to accept insurance from the motorcycle rental company, check the cost of a temporary motorcycle insurance policy. Ask the rental company about the cost of its insurance policy and then get insurance quotes for motorbike insurance from companies offering short-term insurance. You may discover it’s cheaper to get a policy on your own than accept what is offered in the rental agreement.

- International riders: Meeting state insurance requirements can be challenging when visiting the United States and bringing a motorcycle from another country. Short-term motorcycle insurance makes it easier by letting you obtain the insurance coverage you need to know that you are protected in case of an accident and also in compliance with the law without paying for a longer term than you need.

- Borrowing someone’s motorcycle: Relying on the owner’s insurance policy when you borrow someone’s motorcycle could be a mistake unless you read and understand the policy terms. Instead of taking a chance that you may be riding without insurance, a motorbike insurance policy for the time you have possession of the borrowed bike gives you peace of mind of knowing that you have insurance.

- Buying a new motorcycle: You found a motorcycle to buy before shopping for insurance, but the seller wants an answer right now. The solution is to get a temporary policy now to keep the seller happy while giving yourself time to shop for the best insurance rate on a long-term policy.

Whatever your situation, short-term motorcycle insurance may offer a way to get the coverage you need without paying for coverage you can’t use.

Temporary motorcycle insurance offers an alternative to standard motorcycle insurance policies when you don’t need insurance all year. Short-term policies let you customize the coverage time to accommodate your needs. Shop around to find the best motorcycle insurance at an affordable price.

FAQs about temporary motorcycle insurance

Yes, businesses can obtain temporary insurance for motorcycles. Be prepared to give the insurance company accurate information about the intended commercial use, such as leasing motorcycles to make deliveries, to ensure you get an accurate quote.

You might need short-term motorcycle insurance for several reasons, including renting a motorcycle, test riding a bike before you buy it, participating in track-day events, and during storage periods. The length of the coverage period can be tailored to your specific need.

Talking to insurance companies about the types of temporary insurance coverage they offer is the best way to start shopping for temporary motorbike insurance. Online resources, such as those provided in this guide, give you access to insurers to discuss rates, coverage periods, and other information you need to decide.

Temporary motorbike insurance and other insurance you have worked independently of each other, including claims. However, carefully review the terms of your insurance policies and speak with your insurance agent to understand how the policies work.

The answer depends on your insurance company and the policy terms. Some insurance companies allow you to add temporary coverage, but you should speak to a representative at your insurance company to learn about their specific policies regarding short-term motorcycle insurance.

The answer depends on your intentions about riding your motorcycle. The benefit of temporary insurance is that you do not pay for insurance for times you are not riding. A standard policy may be more cost-effective if you ride for six months or more during the year.

Any limitations or restrictions on short-term motorcycle insurance depend on the insurance company and its policies. Some companies may limit the length of the coverage term of their policies, restrict how the insured motorcycle may be used, or exclude high-risk activities from coverage under the policy. It’s best to ask insurers to explain their limits and restrictions or have a lawyer review the policy.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.