The average cost of motorcycle insurance in the US is $702 per year ($59 per month). The cost of your insurance will depend on the coverage selected, the age of the driver, their driving record, the state the motorcycle is registered in, and various other factors. What affects the cost of motorcycle insurance the most? Let’s look at what makes the most difference:

Age & Gender of the Rider

Motorcycling is thrilling whether you’re 15 or 50, but the cost for insurance can be drastically different throughout your riding career. Age and gender play significant roles in the cost of your insurance, but they may not tell the whole story. There are price breaks built into insurance, and the cost typically goes down when you reach 21, 35, and 50 years of age. Beyond that, it stays steady until you reach your 70s. At that point, you may see a slight increase as riding past 70 sees more accidents and insurance claims.

As we mentioned above, age doesn’t tell the whole story, as riding experience can often influence the cost depending on the insurance company you choose. A fresh 18-year old rider that just took a safety course will likely pay more than a 25-year old with five years of riding clean experience. More experience indicates less risk, and your insurance cost should reflect a difference.

Gender is also another significant factor in the cost of your insurance. In general, males pay more. You may think it’s unfair, but the truth is that more claims and accidents are caused by men as the driver of the motorcycle. The 2017 fatality statistics released by the IIHS showed that 9 out of 10 fatalities on a bike were from men having an accident as the driver of a motorcycle. The injuries statistics follow suit, so the insurance claims and costs generally affect the men far more than women.

Your Driving Record Follows You

The next factor that influences your insurance cost is your automobile driving record. How you drive a car directly correlates to how you ride a motorcycle. Have tickets or accidents in your car or truck? These indicate that you should show the same tendencies on a motorcycle too. If you are unsure of how owning and insuring a motorcycle will affect your bottom line, get a quote from your current insurance company. Beyond that, get a handful of quotes from other companies, whether you use them for any additional insurance or not. Bundling policies can save you money, but going with a different company may save you the most money.

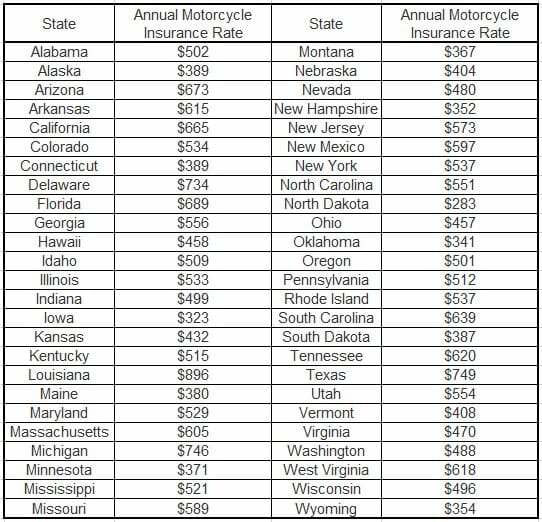

What State You Live and Register the Motorcycle In

Location, location, location. It’s the one-liner you hear about real estate, and that real estate can affect how much you pay annually for insurance. Warmer states that have longer riding seasons have more opportunities for accidents and insurance claims. The opposite can be said for states with a colder climate and shorter riding season. Beyond what state you live in, where you live in the state can affect the insurance rate also. Living in a large city will require a higher premium as it indicates more opportunities for an accident while living in a rural area may be less.

The average annual rate for motorcycle insurance is $519. That can vary by city and state by the simple fact that each state can require different levels of coverage. The below graph shows the average by state using a 45-year old male as an example. The insurance coverage is set at bodily injury protection of $100,000 per person / $300,000 per accident and $50,000 in property damage. The deductibles for both comprehensive and collision coverage were $500. Up to five quotes were obtained for each state, but the location inside the state was not specified.

As you can see from the chart, in general, the southern band of states in the U.S. has higher than average insurance rates. In contrast, the Midwest and northern groups of states have a cost lower than the average. There are individual states that buck the trend like Michigan and Massachusetts that are northern states but have rates higher than the average.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

Your Motorcycle Itself Affects Your Insurance Rate

You would expect your motorcycle itself will drive the insurance rates up or down depending on what it is, the safety ratings, and how often you ride it. The same is reviewed for an automobile when you change or request new insurance. These are many of the options verified when insurance is quoted:

- Motorcycle Value

A more expensive motorcycle will naturally cost more to insure. The value to replace the motorcycle, whether new or used, is a direct driver of the insurance rate. Limited editions or rare vintage motorcycles may add more than you expect to pay too

- Engine Capacity

A larger displacement engine may add cost to the policy as it could indicate a higher likelihood of an accident, more tickets, or more claims.

- Safety Ratings

A motorcycle with a higher crash rating, or shown to be safer, should reduce the insurance policy rate. Adding safety features, such as an anti-lock braking system, may decrease the policy rate and needed coverage.

- Crash Rate

You wouldn’t think that your riding partners with the same motorcycle could affect your rate, but they can. Motorcycles, whether model-specific or types in general, can be classified together as more likely to have accidents. When that happens, it gets a bad name and can affect other policyholders, whether they have any accidents or not. You can check ratings of most motorcycles when they are first sold or after a few years on the road if you plan to buy used.

- Theft Rate

Any motorcycle that is a prized target for thieves will have an additional cost to insure. Motorcycles are far easier to steal than automobiles for the simple fact that they can be rolled onto a truck or trailer or into a van and driven away without anyone noticing.

- Type of Motorcycle

The type of motorcycle also adds a cost to the policy based on what it is. Sport motorcycles, designed to be light and fast, are among the highest to insure as they are stolen more often and crashed more often. Cruisers tend to be in the middle for costs, but there are larger engine displacement options that can increase the cost. Touring motorcycles, although having larger engines, are among the cheapest to insure. They are stolen less and crashed less, so the risk to own and insure them remains one of the best options.

Other Factors That Drive Up Insurance Rates

Credit and coverage selection are two more things that can affect your insurance rate. Poor credit may indicate reckless or poor decision-making. In contrast, a high credit score may show that you are a cautious individual with your choices. Beyond credit, the coverage selection may add a significant amount to the policy price. Hefty insurance coverage could double or triple the insurance price. Be sure to look at all options carefully and select what you feel comfortable with and think is necessary.

How Can You Reduce Your Rates

After reading all the factors that can increase your insurance rates, it may sound like only doom and gloom. There are things that can decrease your rates and work in your favor:

- Taking a motorcycle safety class

Whether you’re a new rider or a seasoned veteran, your insurance rate may benefit from a safety course. Check with your current or potential insurance company if a course will add a discount or decrease your rate. Not all courses may apply, so be sure to check the details.

- Manufacturer Owners Groups

There are owners groups like the Harley-Davidson Owners Group (or HOG for short) that work with insurers in 42 states to offer special discounts for members. H-D isn’t the only manufacturer helping their brand ambassadors either. Check what is available when you’re shopping for your next motorcycle.

- Policy bundling

Your current insurance provider may offer an extra discount for adding a motorcycle to your current policy options. Work directly with your local insurance agent or a representative from your provider to understand what is available.

If you’d like more information on motorcycle insurance such as company ratings, quotes and tips to choosing the best coverage, visit our Motorcycle Insurance Guide For 2020

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.