It’s a sad truth that motorcycles face higher risks than all other types of motorized vehicles. This is why motorcycle insurance is generally more expensive than car insurance. While the average road bike costs less than an automobile, riders face significantly higher risks of death, injury, or accident, which translates to higher insurance premiums.

As a result, most riders look for budget-friendly insurance policies that sufficiently cover the basics without breaking the bank. Here we’ll discuss the cheapest motorcycle insurance, and what to look for before availing of one.

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

What Affects Motorcycle Insurance Rates

Like other road vehicles, the insurance premium for motorcycles is influenced by several factors. These include:

The type of insurance coverage

- Insurance policies range from full-coverage to partial-coverage such as coverage for damages to yourself, the bike, or other parties.

- Most states require two types of liability coverage: bodily injury and property damage.

The bike model

- Newer model motorcycles are likely to have higher premiums than older bikes.

- The type of bike and engine displacement also plays a factor. Sport and racing models with higher cc cost more to insure than the average touring or commuter bike.

- Some insurers offer a discount if the bike has factory ABS.

The insured value

- This refers to the value of your bike and your chosen coverage limit.

- The bike’s insured value is determined by the insurance company, but the medical coverage and liability coverage value is determined by the insurance premium you are willing to avail.

The driver’s physical condition

- Age is one of the biggest factors, with younger riders costing higher than older ones.

- Riding experience is also a determining factor. Some insurance providers specialize in motorcycle insurance for new riders, while others do not accept beginners.

Driving record

- Violations and penalty strikes impact insurance rates, regardless of whether it happened while driving a bike or another vehicle.

- Some driving violations such as a DUI require an SR-22 or FR-44 certificate of financial responsibility, which must be filed by an insurer on behalf of the rider. And not all insurance companies provide coverage for such certificate holders.

Accident and claim history

- Some providers use an “insurance score” much like a credit score. This is determined by the rider’s claim history and financial capacity.

- Any accident and claim regardless of the vehicle used increase insurance rates.

Credit rating

- Many insurers check credit scores, and a bad credit rating can negatively affect the rate.

Location

- Urban areas are more likely to have higher rates, due to the greater risk of accident or theft.

- States with more stringent insurance regulations also have higher premiums as a result.

- Insurers also look at your ability to secure your bike, such as having a garage.

Deductibles

- Choosing a higher deductible results in a lower rate, since the insurer will pay less in the event of a claim.

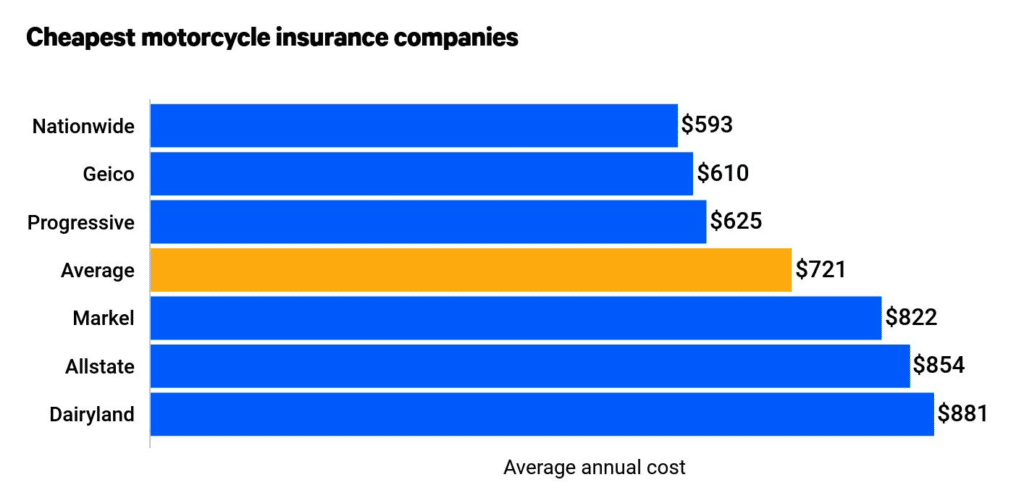

The Cheapest Motorcycle Insurance Providers

We’ve gathered the motorcycle insurance companies with the lowest rates. Do note that some may not be available in your state.

Cheapest Motorcycle Insurance: Geico

One of the biggest names in auto insurance, Geico has the lowest motorcycle insurance rates in the industry, full stop. The average Geico annual policy comes to about $530+, which is dramatically lower than the national average of over $700. In fact, the company has the lowest rate in the 5 states with the most registered motorcycles (California, Florida, Ohio, New York, and Pennsylvania).

Pros:

- Overwhelmingly cheaper than the insurance average for most states by as much as 25%

- Numerous customer satisfaction awards and AA+ financial rating

Con:

- Bundling can be a bit of hassle as it’s often done with third-party providers

Cheapest Full-Coverage Motorcycle Insurance: Progressive

A full-coverage Progressive policy only costs around $825 annually, considerably below the full-coverage rates of other providers.

Pros:

- Unrivaled policy coverage, such as OEM parts coverage and replacement cost coverage

- Riders who opt for comprehensive and collision coverage also get up to $3,000 worth of custom parts protection coverage

- Easy discounts such as using electronic payments and on-time payments.

Cons:

- Average J.D. Power customer satisfaction and B- rating from BBB

- Add-ons such as increased liability coverage can be pricey

Cheapest Motorcycle Insurance for Inexperienced Riders: Nationwide

This insurance company consistently offers some of the lowest rates for riders below 21 years old. For older bikers, the average annual policy is about $550+, way below the national average, and only slightly more expensive than Geico.

Pros:

- Nearly 50% lower rate for 18-21-year-old riders compared to the average premium for this age group

- Accepts high-risk and high coverage limits

- 9 discount factors

- Vanishing deductible option

- 24/7 online claims support

Cons:

- No price lock-in or total loss coverage

- No discounts for renewal, switching, or having no-fault accidents

- Not available in Alaska, Delaware, Hawaii, New Hampshire, Montana, Vermont, Wyoming

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

For 2022, Nationwide remains unbeatable when it comes to the lowest premium among motorcycle insurers.

Geico comes second with their average rates being only slightly higher than Nationwide’s. Their extensive array of insurance products makes them an attractive choice for bike owners who wish to bundle their insurance, and the brand is also more accommodating to high-risk riders.

While not having the same nationwide presence as the big dogs, Progressive presents a good insurance option in the states where it operates. The company’s quotes can a higher percentage cheaper than the average insurance premium.

Note that motorcycle insurance quotes vary per rider and location. The figures shown above are the average motorcycle insurance policy rates for each company.

HOW TO LOWER YOUR MOTORCYCLE INSURANCE COST

Finding the cheaper motorcycle insurance provider is just part of the equation. Since insurance quotes vary per person, the premium you get depends largely on YOU as a rider.

Here’s what you can do to lower your insurance rate:

1. Maintain a good driving record

- Insurers will examine your driving record for violations, accidents, or claims, regardless of the vehicles used.

- In most states violations are stricken from the record after 3 years, and will not impact insurance premiums.

- Quotes will be higher if they see any past claims, especially if there were any at-fault accidents.

2. Have a good credit history

- A poor credit score means the insurer has to take higher risks in case the rider defaults on their financial obligations.

- Credit scores range from 300 to 850, and ratings over 600 are generally considered satisfactory by most insurers.

3. Brush up on your riding skills

- Enroll in a safety course to improve your riding. This also makes up for lack of experience in case you’re a new rider.

- Taking a safety course also serves to mitigate any record violations.

4. Join a club

- Members of a bikers’ club usually enjoy lower insurance rates by pooling applications together.

5. Bundle your insurance

- Insurance companies provide discounts if you avail multiple products, such as bundling your car and motorcycle insurance with them.

- This also makes the billing and paperwork easier to track by dealing with a single insurance provider, instead of multiple ones.

- Another way to pay the insurance in full rather than in installments to enjoy a discount.

6. Modify your coverage for the season

- You can lower your coverage during periods when you ride less often, such as the winter.

- You can also do this if the bike will be stored for a long period of time, such as undergoing repairs in the shop.

- Just remember to switch back to your regular coverage once the bike is out or when the riding season starts.

7. Adjust your deductibles

- Insurance rates are lower if you choose to have a higher deductible.

- This means that you assume more of the cost in case of a claim, so the insurer will have to pay out less.

- Make sure to ask how much difference the deductible makes for the premium. In some policies like comprehensive coverage, a higher deductible may have minimal impact on the overall cost, and only serves to reduce your coverage limit.

8. Secure your bike

- Insurers will examine your ability to keep the bike secure from theft or damage, so a covered garage helps.

- If you live in the city, a covered parking slot or storage lockup can be beneficial.

- Theft-recovery devices can also help, such as a professionally installed GPS tracker

For more information about motorcycle insurance providers based on different criteria, check out our Best Motorcycle Insurance for 2022 guide.