Apart from being a lot of fun to ride on long trips over open roads, motorcycles also offer a gas-friendly alternative to cars and SUVs for the morning commute to work or school or for running errands around town. Regardless of your reason for owning and riding a motorcycle, staying safe and avoiding accidents should always be a priority.

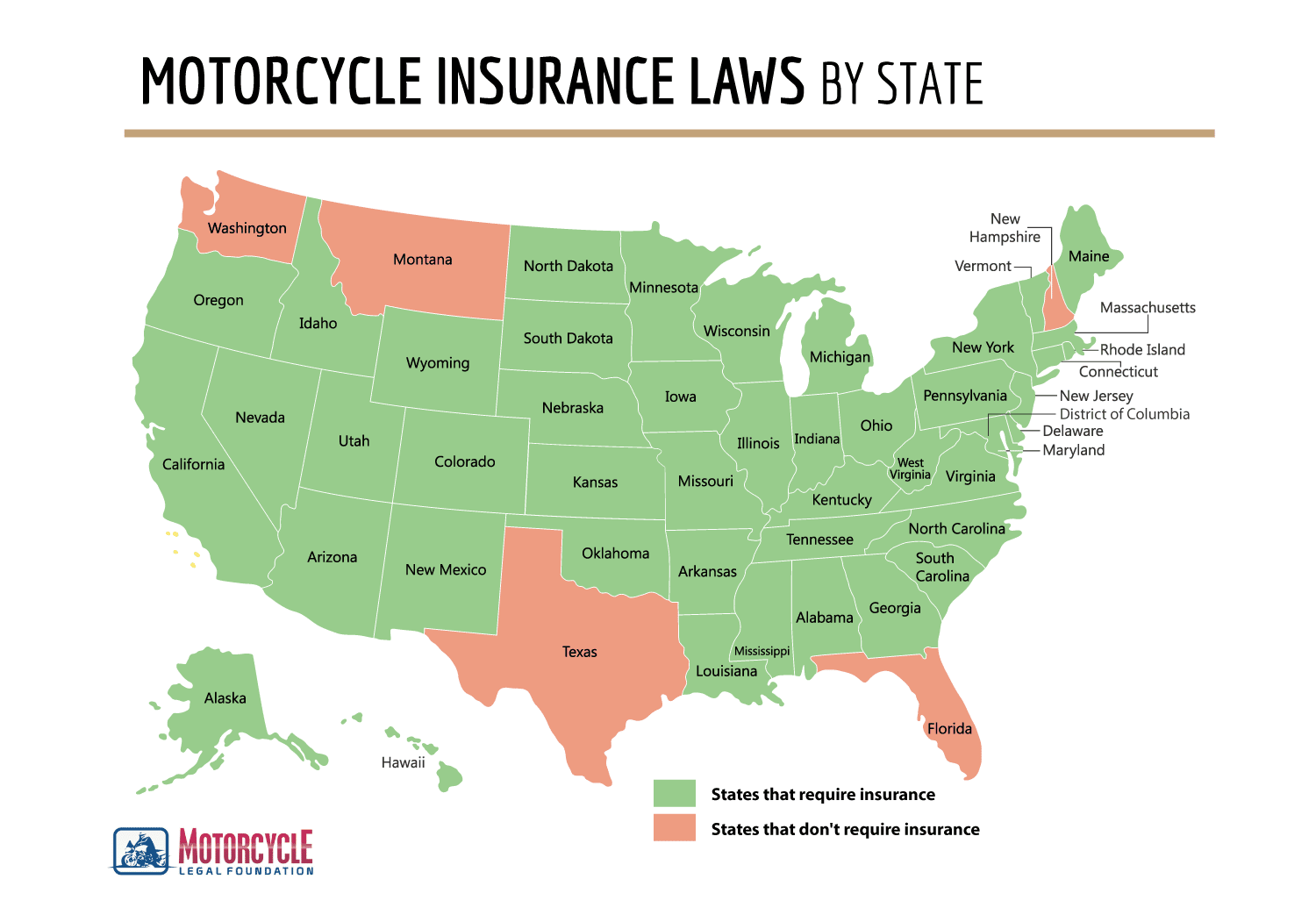

Accidents bring with them legal and financial consequences whether you are at fault, or they are caused by the negligence of someone else. All states, except for Florida, require insurance in some form to register and legally ride a motorcycle.

According to the most recently available data, there are more than 8.3 million registered motorcycles in the United States. When motorcycles crash, the injury rate is 992 per 100,000 registered motorcycles. The fatality rate per 100,000 registered motorcycles is 67, but it can be as much as four times higher for riders and passengers on super sport motorcycles capable of extreme acceleration rates and speeds.

Motorcycle insurance will not prevent an accident, but it does offer financial protection against lawsuits and claims made against you by passengers injured while riding with you and by other parties injured in a crash that you caused. Some policies protect the insured by paying toward the cost of medical care when you are injured in a crash.

If you are on the fence and asking yourself, “Can I ride a motorcycle without insurance?” continue reading. The information in this article gives you the facts to make it easier to understand and shop for motorcycle insurance, so you will comply with the law and be financially protected in case of a crash.

If you are on the fence and asking yourself, “Can I ride a motorcycle without insurance?” continue reading. The information in this article gives you the facts to make it easier to understand and shop for motorcycle insurance, so you will comply with the law and be financially protected in case of a crash.

Why You Should Have Motorcycle Insurance

The fact that 49 out of 50 states require motorcycle insurance of some type to register and legally ride should be reason enough to contact an insurance agent to arrange for coverage. A frequent argument heard from people who are opposed to insurance is how much money you waste paying for something that you may never need to use.

That argument doesn’t hold up when you consider the potential cost when someone injured in an accident blames you for causing it and files a lawsuit for damages. First, you need to hire and pay the legal fees for a lawyer to defend you in the lawsuit. Even if you win the case, you still must pay the legal fees and litigations costs, including:

- Deposition and transcript costs

- Expenses to acquire copies of medical records

- Fees charged by expert witnesses

- Fees charged by investigators and accident reconstruction experts

If you lose the lawsuit, the injured party has a judgment against you for the amount of the jury verdict. A judgment gives the injured party the right to seize your assets, garnish your wages, and take other steps to collect what is owed.

The premiums you pay for motorcycle insurance include liability coverage that pays judgments or settlements up to the coverage limits of the policy. It also pays the legal fees and litigation expenses to defend you against the claim.

You may consider yourself to be an extremely safe rider, so the risk of financial ruin from defending and paying a claim for damages because you caused a crash may not persuade you to buy motorcycle insurance. In that case, consider what motorcycle insurance has to offer when the driver texting on a cellphone forgets to stop at a red traffic light or when a motorist decides to make a left turn as you approach an intersection.

Coverages are available to pay for repairs to your motorcycle after a crash or replace it when someone steals it. Some policies pay for medical expenses that you incur for injuries received in a crash while other coverage offers financial assistance when the person responsible for causing a crash does not have insurance or does not have enough insurance to compensate for your damages.

The financial benefits of having motorcycle insurance may not be enough to convince you to get a policy. Do you need motorcycle insurance to ride a motorcycle? Well, unless you live in Florida where mandatory insurance for motorcycles is not the law, the answer is “yes.” Unless you want to pay the price in terms of fines and other penalties that all of the other states impose on uninsured riders.

States with mandatory motorcycle insurance laws impose fines and license suspensions on people who violate them. California takes the penalties to an even higher level. If you own or operate a motorcycle or other motor vehicle involved in a collision and were injured, California law prohibits you from recovering non-economic damages for injuries sustained in the crash.

Want Cheaper Motorcycle Insurance?

Start saving today with a free quote from our trusted insurance partner.

You can recover economic damages from someone whose negligence caused the crash even if you did not have insurance. Economic damages include:

- Medical expenses

- Physical therapy and rehabilitation costs

- Lost wages

- Cost of specialized medical equipment

- Damage to property

The law in California prevents you from suing and recovering non-economic damages, including:

- Physical and emotional pain and suffering

- Loss of companionship

- Diminished enjoyment activities engaged in before the accident

Non-economic damages can be significant in a motorcycle accident, so the effect of the law in California could be to deny an injured person a substantial amount of money because of not complying with compulsory insurance laws.

Types Of Motorcycle Insurance Coverage

The insurance you have on a car or other motor vehicle that you own does not cover your motorcycle. It will not pay claims in the event of a loss nor allow you to register your motorcycle and legally ride it on the street.

Companies that insure motorcycles offer a variety of coverage options. Some of them may be mandatory under the law in the state you live in or ride, so check with your state motor vehicle agency to find out the coverage that you must have to register your motorcycle.

Motorcycle insurance coverage generally available from insurance companies include the following:

Bodily Injury/property Damage Liability

Liability coverage protects you when another party files a claim for injuries in an accident by providing a lawyer to defend you and, if necessary, paying the claim. Coverage is expressed as three names, such as “25/50/25.” It means that you have $25,000 of insurance for claims made by one person in an accident, $50,000 total coverage per accident for injuries more than one person, and $25,000 coverage for property damage in an accident that you cause.

Collision

Regardless of fault on your part in causing a crash, collision coverage pays the cost of repairing or replacing your motorcycle after an accident. There may be a deductible that you must pay, but it’s a small price to pay when you consider the cost to buy a new motorcycle.

Comprehensive

Damage to your motorcycle caused by an event other than an accident is paid for under comprehensive coverage. Theft, fire, vandalism or natural disasters, such as a flood or tornado.

Medical Payments

MedPay covers medical expenses incurred by you or a passenger when injured in an accident regardless of who was at fault. Your premium is based on the coverage amount you select.

Uninsured/underinsured Motorist

If you have an accident caused by another driver who flees the scene or has no insurance or only limited coverage, you may file a claim with your own insurance company.

Roadside Assistance

Towing or roadside assistance insurance comes in handy when your motorcycle breaks down or is damaged in a collision and you need a way to get it back home or to a mechanic.

Custom parts and accessory coverage

The accessories you add to personalize a motorcycle may not add to its value and be paid through your collision or comprehensive insurance.

Rental reimbursement

If you need to rent a vehicle to get home after an accident or breakdown, rental reimbursement pays all or a portion of the cost.

Off-road insurance

Companies offer a variety of coverages for damage to off-road motorcycles and trailers used to get them to the riding location

You decide on the coverage limits that you want, so you can, and probably should, increase the bodily injury liability coverages if you live in a state with very low mandatory requirements.

What States Don’t Require Motorcycle Insurance?

Laws frequently change, so always check the law in your state or in states that you plan to ride through for the latest information about insurance requirements for motorcycles.

New Hampshire

Only a few states, like New Hampshire, do not mandate vehicle insurance. What then is needed? Whether you have insurance or not, there will definitely be a sizable bill to pay if you cause an accident involving another vehicle. You are responsible for any damages and injuries that occur from the collision. You’ll need to provide evidence of financial responsibility to show you have the money to cover damage after an automobile accident.

- $25,000 bodily injury liability per person

- $50,000 bodily injury per accident

- $25,000 property damage liability

Montana

This state did not require insurance for motorcycles for many years, but the law now includes motorcycles used on highways as motor vehicles that must have minimum liability insurance with limits of $25,000/$50,000/$20,000.

Florida

It is the only state that does not require insurance to register and ride a motorcycle, what that actually means to you may be confusing because of the way the state applies its laws. If you are over 21 and choose to wear a helmet when riding, you do not need insurance. However, riding without a helmet is only lawful if you have a medical payments policy with at least $10,000 in coverage to pay your medical treatment for injuries suffered in a crash.

Florida has a law requiring that motorcyclists show proof of financial responsibility in the event of an accident, which may create confusion for anyone who thought that motorcycle riders in Florida did not require liability insurance. Unless you have a net worth to be capable of paying claims for injuries or property damage in an accident, you must provide a liability insurance policy to satisfy the state’s financial responsibility law with the following coverages:

- $10,000 bodily injury to one person

- $20,000 for bodily injury to two or more people per accident

- $10,000 property damage per accident

Gear Up with New Arrivals

Cooler days are coming. Big savings on high-end motorcycle apparel.

Texas and Washington

To be able to drive lawfully in Texas, drivers must have a certain amount of liability insurance. The same requirements are applied to the state of Washington.

Amount of liability insurance required in Texas

- $30,000 bodily injury liability per person

- $60,000 bodily injury per accident

- $25,000 property damage liability

Amount of liability insurance required in Washington

- $25,000 bodily injury liability per person

- $50,000 bodily injury per accident

- $10,000 property damage liability

If you do not have proof of financial responsibility, you are subject to suspension of your license on top of being liable to pay judgments from the accident.

Conclusion

When you consider the financial burden of a claim for injuries or property damage from an accident that was your fault, paying the cost of a motorcycle insurance policy certainly makes sense. It also prevents violations of state laws that could require payment of fines and the suspension of your motorcycle license.

Even if you live and ride in Florida, which lets you register a motorcycle without showing proof of insurance, you still need a policy to ride without a helmet or in case of an accident. Riding without at least minimum liability insurance coverage is simply not worth the risk.