We all know that motorcycle insurance can be quite a pain in the rear. If being more expensive than car insurance wasn’t enough, new riders also have to contend with higher premiums compared to older or more experienced motorcyclists.

For new bikers looking to get their first motorcycle insurance, read on to get the best insurance quote for your buck.

What Are the Different Types of Motorcycle Insurance?

The first thing you need to know is that there are different types of motorcycle insurance. Some types are mandatory in some states, while other states have fewer requirements.

Motorcycle Liablity Insurance

This pays for injuries or damage caused to the other party if you are at fault in an accident. Most states require riders to have liability coverage, with the minimum amount depending on each state.

There are two types of liability insurance:

- Bodily injury liability – covers medical expenses related to the other party’s injuries. In some states, this automatically includes any passengers you may have on your bike, while other states require an additional premium for the passenger.

- Property damage liability – covers compensation for any damages incurred to the other party’s property.

Collision Coverage

This pays for the repair or replacement of your bike in the event of a collision with another vehicle or with an object. This comes with a deductible, which is your share of the repair or replacement cost.

Comprehensive Coverage

As the name suggests, this covers damages beyond collisions. These can include theft, vandalism, disasters or environmental factors, depending on the policy. Like collision coverage, it also comes with a deductible.

Medical Payments Coverage

This covers any medical expenses you may incur in the event of an accident. This type of insurance is highly recommended since motorcycles have a greater risk of accidents compared to all other types of vehicles.

Personal Injury Protection

Some states define this coverage as paying for injury-related expenses, regardless of fault. It can also extend to incidental costs, such as lost wages.

Uninsured/Underinsured Motorist Coverage

This coverage helps pay for your expenses if the accident was caused by an uninsured or underinsured party. The policy can be for bodily injury or property damage. This also applies in case of hit and run incidents where the at-fault driver cannot be identified.

Optional Equipment Coverage

This is useful for customized bikes that have been upgraded with aftermarket parts or cosmetic modifications. It can also include rider safety gear.

What to Look For in a Motorcycle Insurance Policy

As a newbie, it can be quite daunting to compare insurance quotes and coverages from different providers. To make your insurance shopping easier, consider these factors:

- The liability limit – In the event of an accident where you are at fault, you may be liable for medical expenses, property damage and legal costs. You may want to get a limit that covers the value of your personal assets.

- Personal injury coverage – Compared how this is covered if it comes from an HMO or as an add-on in the form of personal injury protection or medical payments coverage.

- The value of your ride – Assess your bike’s fair market value as this determines the premium you will pay, as well as the limit of your insurance payout.

- Accessories and equipment coverage – Some companies offer free accessories coverage, while it’s an add-on for others. Check what is covered.

The Best Motorcycle Insurance for New Riders

There are several reasons why we pick Allstate as our top motorcycle insurance choice for new riders. For one, they have a First Accident Waiver that forgives the first accident without raising the premium. Then there’s the Allstate Rider Protection Project, a program that provides safety training for new riders. And unlike other insurers, roadside assistance is free.

Allstate also offers the widest range of coverage options, including towing, lease/loan gap coverage, and rental reimbursement.

Pros:

- First accident waiver

- Safety training program

- Drivewise app offers rewards for safe riding

- Streamlined quote process

- Free roadside assistance

Cons:

- Rates tend to be higher than the national average in most states

- Getting quotes online can result in a sales call

Best for:

Riders looking for the widest coverage options

Note: One of our newbie-friendly motorcycle insurance picks, Esurance, was retired at the end of 2020 and absorbed by Allstate.

Progressive is notable for consistently having some of the lowest rates among motorcycle insurers, thanks to their direct-to-consumer system that leaves out agents. For new riders, the company’s Small Accident Forgiveness covers collision accidents that cost below $500 (after paying the deductible) without affecting the premium.

Progressive’s easy quote and claims process, as well as its broad range of discounts compared to other insurers, make it our top pick as the best motorcycle insurance overall for 2021.

Pros:

- One of the lowest premiums on the market

- Widest range of discounts

- Easy quote process and claims

- Covers the broadest range of motorcycles, including from mopeds and scooters to dirt bikes, trikes, ATVs and UTVs.

Cons:

- No free roadside assistance

- Not all discounts are available in all states

Best for:

New riders looking for the lowest insurance rates or hassle-free applications

Riders with unique motorcycle classes

Another household name in insurance, Geico is great for its massive list of discounts for new riders wishing to save on premiums. It also offers a 20% discount for completing a Motorcycle Safety Foundation or Military Safety Course.

Geico is unique in that accessories coverage is automatically included in its collision and comprehensive policies. This coverage extends to the helmet, electronics, seats, backrests, chrome pieces, and even saddlebags, making it a great choice for customized or heavily outfitted rides.

Pros:

- One of the longest discount options among insurers

- Free accessories coverage

- Free roadside assistance

- Safety course discount

Cons:

- Fewer add-on choices than other insurers

- Limited policy customization options

- Bundling is done through third-party insurers

Best for:

Riders looking for more discount options

Heavily accessorized bikes

A renowned brand among motorcycle enthusiasts, Harley also provides insurance policies for bikes of any brand, known as HD Insurance. The Harley-Davidson Riding Academy offers motorcycle safety courses for reduced premiums, and there are options for loans, theft protection, and aesthetics coverage. What sets HD Insurance apart is its equipment replacement cost coverage add-on, which reimburses riders for the cost of a replacement instead of the depreciated cost of the equipment that needs to be replaced.

The brand also offers a dedicated Visa credit card where points can be redeemed for Harley-Davidson gear.

Pros:

- HD Riding Academy for lower premiums

- Underwritten by the Sentry Insurance Group, which has an A.M Best rating of A+ (Superior)

- Vacation rental insurance covers any motorcycle you rent, as well as incidental expenses like food and lodging if the accident occurs 100 miles from home.

Cons:

- Slightly more expensive than other insurance providers

- No free roadside assistance

- No bundled insurance packages such as home or auto

Best for:

New members of the Harley Owners Group (H.O.G.)

Riders who love to go on long rides

Customized motorcycles

Need Motorcycle Insurance?

Enjoy your ride while feeling safe with the best insurance coverage.

New Rider Motorcycle Insurance FAQs

How do I know what type of motorcycle insurance is required in my state?

47 states except for Florida, Montana, and Washington require motorcycle insurance. For liability insurance, you can check your state’s requirements here.

What’s the average insurance cost for young riders?

The average motorcycle insurance cost for an 18-year-old is $998 per year. However, this can differ by as much as $700 depending on your home state, driving record, bike, and policy inclusions.

Does motorcycle insurance get cheaper the longer I ride?

Not necessarily. Motorcycle insurance premiums are determined by:

- Driving record

- Age and rider condition

- Any history of claims, even if it’s for a different vehicle

Most insurers do offer discounts for clean driving records, policy renewals, or no prior claims.

Click here to learn more about all the factors that affect your insurance cost.

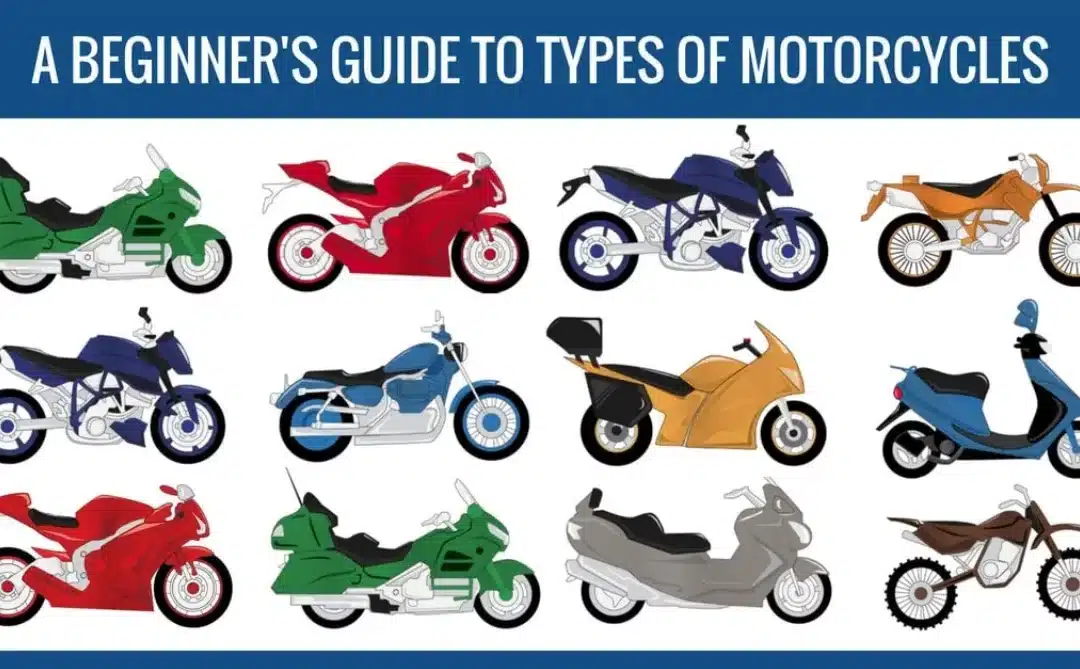

What types of motorcycles have the lowest insurance cost?

Newer bikes typically cost more to insure compared to older depreciated ones. In terms of model, standard commuter bikes and cruisers have the least insurance cost, while sportbikes, racing, and rare/vintage models command the highest premiums.

Other factors include:

- Engine displacement

- Safety ratings

- Crash rate

- Risk of theft

For scooters and mopeds, the average annual premium is $250, with some companies like Geico and Progressive offering dedicated coverages for the class that are lower than motorcycle insurance premiums.

You can check out our list of newbie-friendly bikes with low insurance costs.

How can I reduce my motorcycle insurance rate?

For new riders:

- Take a motorcycle safety course

- Join manufacturer owners’ groups or bike clubs for group discounts

- Bundle your home or auto insurance with the same insurer if available

- Have a good credit score

As you gain more experience, you can gain more discounts through policy renewal / brand loyalty, spotless driving record, etc.